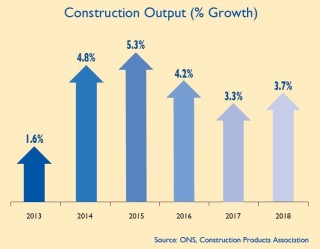

The Construction Products Association autumn forecasts predict that construction output will grow 4.8% in 2014 and 5.3% in 2015, before slowing a little to 4.2% in 2016. The 2015 figure represents a firm upward revision from its previous forecast of 4.8% growth.

Private housing starts in Great Britain are forecast to rise 18% this year and 10% in 2015, leaving starts at 148,000. In the long-term, slower rates of growth are forecast but by 2018 private housing starts will reach 171,000, forecasts indicate.

Infrastructure output is expected to rise 53.7% between 2013 and 2018. Growth in the sector is anticipated to be driven by a recovery in roads construction, combined with further growth in the rail and energy sub-sectors.

New roads construction is expected to grow by 46.1% between 2013 and 2018, thanks to increased capital investment from the Highways Agency. Energy infrastructure construction is anticipated to double by 2018.

The private commercial sector is set to increase 3.7% in 2014 and 6.1% in 2015.

CPA economics director Noble Francis said: “Our forecasts reflect a welcome, recurring theme as growth continues and begins to broaden. Short-term activity is still led by private housing, infrastructure and commercial, and areas of public sector construction are showing the first signs of increasing strength. We believe the expansion will continue through 2018.

“Recovery is not a foregone conclusion however, and several important risks remain, primarily around the strength of the UK and Eurozone economies, the policy outcomes following the 2015 general election and the impact of any supply constraints such as the scarcity of labour and materials.

Dr Francis continued: “The private housing sector’s rapid growth since early 2013 has been sustained by consistent levels of demand, the general UK economy’s return to health and government policies such as Help to Buy. We forecast starts to rise 18.0% in 2014 and 10.0% in 2015. In order for such projections to be met, however, increased capacity is necessary, particularly from SME house builders. In addition, there remain serious questions about affordability and higher mortgage repayment costs, together with uncertainty around the future of housing policies given the pending election. With this in mind, we forecast private housing growth will moderate in the longer term to 5.0% per year from 2016.

“Commercial, the largest sector, is expected to benefit from a pickup in consumer spending and business investment and drive growth in each year up to 2018. Output in the sector is forecast to reach £26.8 billion in 2018, but this remains 16.6% lower than the pre-recession peak in 2008.

“Offices is one sub-sector of commercial where demand is intensifying in regions beyond London and the southeast. Given this, the association expects new offices construction will expand by 10.0% in 2014 and 8.0% in 2015, followed by 7.0% in 2016.

“Other commercial sub-sectors also show signs of strength. The retail sub-sector remains exposed to the long-term trend away from the high street to internet shopping, and previous peak output levels are unlikely before 2018, but new, large developments should still support growth of 8.0% from 2015.

“Infrastructure output is forecast to rise by 8.2% per year, on average, over the next four years. Roads construction is forecast to increase by 10.0% in 2014 and a further 5.0% in 2015 due to growth in the Highways Agency’s capital funding. Rail output is forecast to rise 8.0% in 2014 and 2015, but from 2016, growth is anticipated to slow, reflecting uncertainty regarding funding.

“Main works at Hinkley Point C may start within 12-18 months as the European Commission stated in October that the ‘strike price’ does not constitute state aid. However, as there have been many delays with the project so far, further delays cannot be ruled out. The energy sub-sector is forecast to grow 10.0% in 2015 before work on Round 3 Offshore wind and Hinkley Point C leads to growth rates of 15.0% in 2016 and 2017 followed by 25.0% growth in 2018.

“Finally, austerity in the previous three years has meant that public sector construction has severely hindered overall construction recovery. In 2013/14, however, we saw the nadir of capital investment falls and consequent rises in funding for schools and hospitals are expected to lead to public sector construction growth averaging 2.6% per year between 2015 and 2018.”

Dr Francis concluded: “The association’s central forecast estimates that construction output will rise 4.8% in 2014, a marginal change from the previous 4.7% estimate. Output is forecast to rise a further 5.3% in 2015, an upward revision from 4.8% growth in the association’s summer forecast due to the continued strength of the UK economy.”

Got a story? Email news@theconstructionindex.co.uk