With new orders falling for the third consecutive quarter and house-building in retreat, a slowdown is set to rock the construction sector, according to consultancy firm Arcadis.

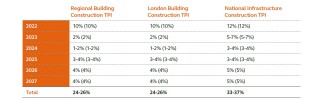

Arcadis’s latest quarterly Market View report makes no changes to its tender price forecasts of three months ago (see image below), but sets out an increasingly troublesome economic background for the UK construction industry.

New orders fell by 7.1% in the three months to June, according to official figures. This followed a 12.4% drop in the first quarter (Q1) of 2023 and represented the third consecutive quarterly fall. This was driven by a drop in public sector ‘other new work’ such as health and education, which fell 33%, as well as a 27% decline in infrastructure new work.

These figures corroborate a recent National Audit Office report, which found the Department for Education was behind schedule for awarding contracts on its 10-year programme of school rebuilding and refurbishment, having awarded just 24 contracts as of March 2023 instead of the 83 targeted.

The Arcadis report, titled Lower for Longer, states that the slowdown in public sector investment shows no sector is immune to a reduction in demand.

The report opens with: “As domestic inflation starts to fall, there is a growing belief that tough monetary medicine is working. However, the cost of success will be even greater than expected. The Bank of England’s prognosis of ‘higher for longer’ interest rates to root out persistent inflation will result in very weak growth between now and 2025.”

Later it says: “BoE’s August update is a tacit admission that more pain will be required if spare capacity is to be created to eliminate inflation. Crest Nicholson’s recent shock profit warning, accompanied by a near 9% hit on the share price, suggests that these measures are already having an impact.

“For a cyclical industry like construction, this spells trouble. Even as industry workload and sentiment remain steady, the foundations for future workload and prosperity are being undermined. The correction, when it comes, could be more substantial than previously thought – as highlighted by a rapidly deteriorating orders pipeline, down by nearly 20% compared to this time last year.”

Despite the report’s broadly negative tone, total output has grown for eight successive quarters, albeit at a sluggish 0.3%. This is largely being driven by the repair and maintenance segment rather than by new build projects.

The construction industry is responding to the storms ahead by battening down the hatches, Arcadis says, with contractors like Wates, Sir Robert McAlpine and Bam restructuring to create efficiencies and refocus on sectors with greater growth potential.

Similar measures can be seen among house-builders like Bellway, which is weighing up the closure of two divisions and redundancies, while brick manufacturer Forterra has outlined job losses following a restructure of its commercial and support operations.

These restructures come amid reports of a high level of business failures across the sector. Latest data from the government’s Insolvency Service showed there were 2,244 business failures in construction in England and Wales in the second quarter of 2023. That is the highest quarterly total since at least 2010 and way above the 1,579 average quarterly total over the past 13 years.

The latest EY-Parthenon profit warning report finds that changing credit conditions triggered one in five profit warnings in Q2 2023, the highest proportion since Q2 2008. This is most noticeable in the housing market, where a slowdown triggered 14% of profit warnings in Q2 2023 and in construction, which saw the highest level of warnings in a single quarter in three years.

Contractors including Higgins Group, Morrisroe Group and the UK-arm of Sisk have all announced pre-tax losses, with most citing the inflation on fixed price contracts as the main trigger. Recent company failures over the summer have included J Tomlinson, Henry Construction Projects, Allma Construction, Buckingham Group Contracting and Ilke Homes.

Simon Rawlinson, head of strategic research and insight at Arcadis, said: “Conditions for our markets have deteriorated significantly over the summer. Borrowing costs are expected to remain high for the next two years and prospects for the investment economy including housebuilding and commercial development are likely to be further downgraded.

“The unexpectedly rapid slowdown in public sector procurement is also a reminder that there are few safe havens for workload other than net-zero and fire-safety retrofit which still see strong demand.

“Our central prediction for the period from 2023 to 2025 remains low inflation, not deflation. However, in the light of worsening data, particularly in connection with the housebuilding sector, we highlight that there is now a material downside risk of a competitive price correction in 2024.”

Got a story? Email news@theconstructionindex.co.uk