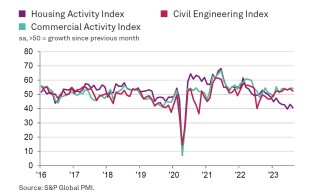

The latest monthly survey of construction purchasing managers shows that growth in the commercial and civil engineering segments was again just enough to offset a slump in house building.

However, business activity forecasts for the year ahead were the weakest since January and, with orders in decline, job creation lost momentum since the previous month.

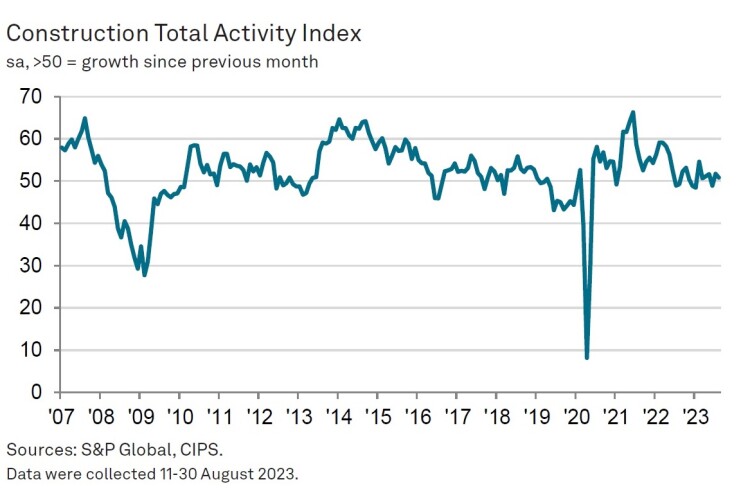

At 50.8 in August, down from 51.7 in July, the headline S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) signalled only a marginal increase in overall construction output.

Commercial building continued to expand, scoring 54.2 in August, compared to 54.4 in July, a five-month high. Civil engineering activity scored 52.4, also indicated growth but not as much as in July (when it was 53.9). August was civil engineering’s lowest score since April.

House-building remained the weakest-performing part of the construction sector, at 40.7, down from 43.0 in July.

August data signalled a decline in total new order volumes for the second time in the past three months, which contrasted with solid growth in the spring. Although only modest, the downturn in order books was the steepest since May 2020.

Construction companies noted that rising interest rates and concerns about the near-term economic outlook had led to more cautious spending among clients, especially in the residential building segment.

Employment numbers increased for the seventh month running, but the rate of growth weakened since July and was only modest. The upturn in subcontractor usage also softened in August, which contributed to the sharpest rise in availability since January 2010.

Suppliers' delivery times for construction products and materials meanwhile improved at a robust pace. The respective index eased slightly since the previous month, but was still the second-highest since April 2009. Survey respondents widely commented on improved stock availability and fewer pressures on supplier capacity.

An improved balance between demand and supply helped to stabilise overall input costs across the construction sector. Latest data signalled only a marginal rise in purchasing prices and the rate of inflation eased since July. A number of firms cited more competitive market conditions and successful price negotiations with suppliers to account for falling raw material costs.

August data indicated that construction companies are relatively cautious about the outlook for business activity during the next 12 months. The degree of positive sentiment slipped to its lowest since January, with concerns about the impact of rising borrowing costs and subdued housing market conditions often cited during the latest survey period.

Tim Moore, economics director at S&P Global Market Intelligence, which compiles the survey, said: "UK construction companies experienced another slump in house building activity during August as rising interest rates and subdued market conditions resulted in cutbacks to client demand and new build projects in particular. Aside from the pandemic, the recent downturn in residential work has been the steepest since spring 2009.

"Resilient demand for commercial work and infrastructure projects are helping to keep the construction sector in expansion mode for now, but the survey's forward-looking indicators worsened in August. Total new orders decreased at the fastest pace for more than three years amid worries about the broader economic outlook and the impact of elevated borrowing costs. Rising risk aversion also meant that construction firms pared back their own output growth projections, with business activity expectations slipping to the weakest since January.

"August data pointed to a welcome stabilisation of costs across the construction sector and another sharp improvement in suppliers' delivery times. Adding to signs of fewer capacity pressures, the latest survey revealed the sharpest rise in subcontractor availability for more than 13 years."

John Glen, chief economist at the Chartered Institute of Procurement & Supply (CIPS), said: "Though the construction sector overall showed an improvement in August, several imbalances in the figures give cause for concern.

"Residential building took another knock further into contraction as new housing starts weakened. The cost of living crisis continued to squeeze household finances and buyers were reluctant to commit in the shadow of potentially another interest rate in September. Housing activity fell at its second sharpest level since 2009, excluding the pandemic years, and overall new orders dropped at the fastest rate since May 2020. The sector was propped up overall by some improvements in commercial activity such as office refurbishments.

"This below par performance had a knock-on effect on job creation which was starting to lose momentum. The right skills remained in short supply and without pipelines of new work coming through, recruitment levels were reduced."

Fraser Johns, finance director at Beard Construction, said: “In spite of persistent challenges for housebuilding, the construction sector as a whole continues to show real resilience with a further increase in output. This has predominantly been driven by both commercial building and infrastructure work, which certainly aligns with our own activity, project wins and future pipeline at Beard.

“While the sector will be encouraged by news of a robust improvement in supplier delivery times and a stabilisation of costs, a decline in total new order volumes will certainly cause some concern. Although inflationary pressures have begun to ease, interest rates and borrowing costs still remain high, which will undoubtedly have an impact on some clients and their appetite and ability to commit to larger projects.

“As a result, we should expect areas such as commercial building and infrastructure new work to continue to lead the recovery effort, especially as frameworks continue to provide valuable projects and fill pipelines across the country. Nonetheless, we must remain responsible with our tendering and cost plans, all while maintaining a constant dialogue with clients to nurture confidence.”

Max Jones, director in Lloyds Bank’s infrastructure and construction team, said: “Despite another rise in output, sentiment remains somewhat subdued among contractors we speak to, with order books and working capital levels flatter than they’d like. Ongoing pressures from the cost and availability of materials also means contractors will be monitoring the health and performance of their supply chains closely.

“However, contractors continue to see opportunities from the post-pandemic shift in working practices, with fit out divisions increasingly the best-performing parts of their business.

“Elsewhere there’s been some green shoots of activity in the regions that have spurred confidence, with work for improvements to public buildings such as schools and hospitals supporting jobs and growth in the sector outside big cities.”

James Bailey, director and UK housing leader at PwC UK, said: “Despite expansions in both civil engineering and commercial work, we see the continued impact of strained market conditions in the housing sector, which posted an index of 40.7 – the second-fastest downturn since May 2020, which was largely due to reduced activity caused by the pandemic.

“High interest rates and difficult buying conditions will have inevitably contributed to the decline in total new order volumes cross-sector for the second time in the past three months. As the PMI notes, the residential building segment is battling with concerns about the near-term economic outlook, which is consequently leading to more caution being exercised in investment. In real terms, this will see the continued slowing of projects and the pace and scale of house building being reined in, until developers can place more faith in the wider economic operating environment.

“Proposed reforms in relation to nutrient neutrality should ease some supply-side constraints, but it will take some time to see their impact come through in numbers. Housing is likely to be a key focus during party conference season, gathering momentum in the build-up to a general election next year.”

Brendan Sharkey, construction and real estate specialist at accountancy group MHA, said that unless the government cuts taxes or the Bank of England reduces interest rates, the housing market will remain flat if not decline:

“Higher interest rates continue to damage the construction sector: the housing market is flat, and confidence remains low. The cost of materials along with interest rate increases are biting into businesses’ tight profit margins. Insolvencies are rising as companies, despite having work, are running out of money to finance their working capital and contracts.

“Introducing cheaper mortgage borrowing rates or reducing stamp duty could encourage activity in the housing market. A stimulus is required but there is no expectation that the government will be announcing tax cuts in the autumn statement nor is the Bank of England planning to lower interest rates. Unless tax cutting measures or a reduction of interest rates to somewhere near 4% are introduced, this will not help with confidence in the market.

“Achieving a minimum EPC C rating on all new lettings by landlords in 2028 is not achievable and is a financial burden for landlords. The EPC rating system is not transparent and is very hard for landlords to understand. Retrofitting also takes time and is costly. The government needs to be proactive in educating home owners, including landlords, on the benefits of retrofitting and where possible provide incentives.”

Got a story? Email news@theconstructionindex.co.uk