This time last year, the UK’s road building and maintenance contractors appeared to be in robust health. Work was coming through in a steady stream and the largest companies were making good profits – indeed, overall pre-tax profits had risen more than 27% in the previous 12 months. This year, though, while the work is still coming in, the contractors are not finding it quite so easy to turn a profit.

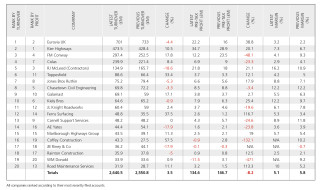

Overall turnover for our selection of the 20 largest contractors in the sector has increased by 3.5%, from £2.55bn to £2.64bn in the period 2017/18. Total pre-tax profits, however, fell by 8.2% to £134.6m (2018: £146.7m) reducing the average margin from 5.8% to 5.1%.

As previously, we have listed only those companies whose principal activity is listed at Companies House as “construction of roads and motorways”. Consequently, a number of major civil engineering contractors – such as Balfour Beatty, Costain, BAM, Skanska and Ferrovial, whose varied portfolios include an enormous share of the UK’s road construction work – are not included here.

Eurovia, the UK arm of the French contractor Vinci, is once again the largest contractor in our top 20. Its turnover for the year to December 2017 was £701m – down 4.4% from £733m the previous year, although it registered a pre-tax profit of £22.2m, an impressive 39% improvement on 2016’s pre-tax profit figure of £16m.

Eurovia is one eight contractors in our table to have recorded a decrease in turnover in its most recent results. For Eurovia, this is the first revenue reduction for a number of years and the company attributes this primarily to “local authority revenue and capital budget decreases across all of our businesses”.

Approximately £486m of Eurovia’s 2017 turnover was generated by its own in-house divisions: Eurovia Surfacing, Eurovia Contracting (North), Eurovia Contracting (South), surface-dressing specialist Eurovia Specialist Treatments and asphalt producer Eurovia Roadstone.

The remainder of its revenues accrue from joint ventures with other firms. These include Ringway Jacobs, with the eponymous consulting engineer; South West Highways, a joint venture with Colas; and Bear Scotland, in partnership with Jacobs and Breedon.

Eurovia says it currently has a forward order book worth around £1bn – the same as the previous year’s.

Kier Highways is one of the more robust performers in the sector, growing revenues by more than 10% to £473.5m in the year to June 2018 (2017: £428.4m) and growing pre-tax profits by 20% from £28.9m to £34.7m.

Its results were boosted by two three-year extensions worth over £250m a year secured on Highways England Areas 3 and 9, and a six-month extension secured on Areas 6 and 8.

Unfortunately the parent’s group results for the first six months of the current financial year (i.e. to 31st December 2018), announced in March, rather took the shine off the successes of its highways division. Kier Group made an operating loss of £20.9m on revenue of £2.2bn for these six months compared to £48.1m profit on £2.1bn of revenue for the same period the previous year.

Most of its problems stem not from core construction work, like building roads, but from support services and facilities management contracts. Its waste disposal contracts, inherited from May Gurney, which Kier acquired in 2013, have proved especially troublesome. Kier has made a £26m provision to cover its exit from one loss-making waste disposal contract.

Leading road maintenance specialist FM Conway also grew revenues in the 12 months to March 2018 (up almost 18% to £297.4m) though pre-tax profits almost halved, from £23.5m to £12.2m. “Included in the results are disruption costs of nearly £1m from the inclement weather in February and March, and a charge of £400,000 for restructuring costs,” explains the company.

In September 2017, FM Conway – listed in third place on our table – acquired a minority stake in East Anglian road surfacing specialist Toppesfield, which comes in at number six.

Toppesfield is a strong performer, building revenues in the year to March 2018 by about 33% to £88.6m (2017: £66.4m) and making a pre-tax profit of £3.7m (2017: £3.3m). The company says that its increased turnover is “due to a mix of increased highways framework volumes, a growth in new clients and expanded geographical coverage for project delivery”.

FM Conway says that its new partnership with Toppesfield “will greatly benefit the Group’s ongoing expansion in its aggregates and asphalt business, as well as providing significantly more confidence in Toppesfield’s supply chain”.

Colas – fifth on our table of the top 20 road-builders – grew turnover in 2017 after seeing revenues dwindle for the previous two years in a row. However, this was at the cost of profitability: pre-tax profit fell by more than 23%, from £9m in 2016 to £6.9m in 2017.

The company says that the increase in turnover was mainly due to “an increase in workload within the highways contracting business which has been successful in winning and delivering new contracts during the year”.

Although operating profit grew from £2.5m in 2016 to £3.7m in 2017, this improvement was “more than offset by a decrease in dividend income from subsidiaries which was £2m (2016: £6.3m) resulting in a lowering of overall profit,” said Colas.

Colas was one of nine contractors among our top 20 to report a reduction in pre-tax profits in their most recent financial results. The average pre-tax profit margin also fell slightly, though it should be said that a margin of more than 5% is not to be sniffed at in this industry.

Nevertheless, the overall reduction in profitability is not insignificant. Costs, particularly in labour and materials, are rising steadily and are affecting contractors across the board.

Last year, only one of our 20 leading road-builders (JB Riney) reported an actual loss; this year Riney (still in the red) is joined by two others: Coffey Construction and Scottish contractor WM Donald. The latter reported a pre-tax loss of more than £11m as a consequence of its settlement with HMRC over tax liabilities relating to an employer-financed benefit scheme (EFRBS). The result was a £14m write-down.

All in all, the UK road-building and maintenance sector can hardly be said to be in crisis, but the modest increase in workloads and reduction in profitability indicate that it’s not a bed of roses either.

Last autumn Highways England announced £8.7bn-worth of work on the national road network over the next six years – great news for the UK’s civil engineering contractors. But then, just last month, the agency announced that 11 of the 112 schemes on its original 2015-2020 investment programme were being “paused indefinitely” as they no longer represent good value for money.

As ever, it’s best not to count your chickens before they’ve hatched.

This article was first published in the May 2019 issue of The Construction Index magazine

UK readers can have their own copy of the magazine, in real paper, posted through their letterbox each month by taking out an annual subscription for just £50 a year. Click for details.

Got a story? Email news@theconstructionindex.co.uk