The wobbles felt by UK house-builders during last year’s Covid roller-coaster ride continued to unsettle the sector’s equilibrium in 2021. Some of the top 20 players are starting to look decidedly queasy as we brace ourselves for 2022.

After a so-so 2019, the sector took a bit of a dive in 2020, with overall revenues among our 20 leading players falling by 8% and pre-tax profits slumping by more than 20%.

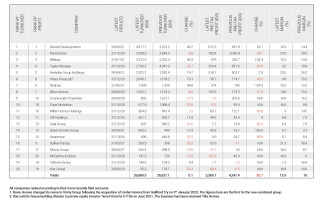

This year, it is more of the same. Total revenues are down – albeit by a relatively insignificant 0.1% from £26.7bn to £26.6bn – but pre-tax profits have again fallen, again by almost 21%, from £4.2bn to £3.4bn.

House-building is a highly profitable business compared with other sectors of the construction industry, but the average profit margin among our selection of top 20 companies has fallen from 16% in 2020 to 12.6% in 2021. In 2019, the average margin was 19%.

There has been a bit of jockeying in the rankings this year, too. Last year, Taylor Wimpey pushed Barratt off its perch (where it had been for at least the past five years) at the top of the table. This year, Barratt has retaken possession of the top spot and Taylor Wimpey is down to number four.

Barratt is justifiably satisfied with its performance in the 12 months to June 2021. Turnover was up nearly 41% from £3.4bn to £4.8bn and pre-tax profit rose to £812m from £492m in 2020 – an increase of 65%.

“We have made huge progress in our recovery from the impact of Covid-19,” said chairman John Allan. “We delivered 17,243 high quality new homes…in 2021, 36.8% ahead of last year and almost back to the 17,856 homes we completed in 2019,” he added.

Also looking good is Bellway, up one place to number three on our table this year. Bellway’s results are for the 12 months to December 2020 and pretty encouraging considering the upheavals last year. It also increased turnover by about 40%, from £2.2bn to £3.1bn, and pre-tax profit more than doubled, from £236.7m to £479m.

Persimmon, also reporting results for 2020, held onto its number two position despite a 9% drop in revenues (from £3.6bn to £3.3bn) and a 25% fall in pre-tax profit. Persimmon has consistently delivered the biggest profits of all the top 20 house-builders in our annual review – last year it registered just over £1bn in pre-tax profit – but this year that figure has fallen back to £784m and Persimmon’s profit is only the second-largest after Barratt’s.

Probably the best-known beneficiary of Persimmon’s ability to turn a profit is the company’s former chief executive, Jeff Fairburn, who in November 2018 was forced out amid a deluge of bad publicity surrounding his £75m bonus.

But it seems you just can’t keep a good man down. Fairburn is back, this time popping up at the helm of Chesterfield-based Avant Homes. Berkeley DeVeer, a small Wetherby builder that Fairburn bought into in January 2020 acquired Avant Homes Group in April 2021 with backing from a hedge fund.

Avant was once known as Gladedale and had been owned by private equity firm Alchemy since 2014. In April, following his acquisition of the business, Fairburn said: “Avant Homes is a fantastic business with a strong proportion and a compelling track record of growth.” This appears to be borne out by the company’s latest results.

In the 12 months to April 2021, Avant turned-over £505m, up 13% from £446m the previous year. Pre-tax profit almost tripled from £16.7m in 2019/20 to £43.9 this year.

Another notable change of ownership this past year was the acquisition of Kier Living by Terra Firma, the private equity firm owned by British financier Guy Hands.

Kier’s house-building business turned over £55.2m in the year to June 2020, down 53% on the previous year (£118m). It also made a pre-tax loss of £89.4m on top of 2019’s loss of £6.5m. The business just makes it onto our table of top 20 house-builders this year.

The Kier board put the house-building business up for sale in mid-2019 in a bid to reduce debt. It was first reported in December 2019 that Guy Hands was bidding for it but the sale was paused in spring 2020 due to the coronavirus outbreak.

Terra Firma finally bought the business, for a reported £110m, in May. Kier Homes has now been rebranded as Tilia Homes.

But enough of the good news – while some companies can point to good solid financial results, the overall picture is not so healthy. Twelve of this year’s 20 biggest house-builders saw turnover decline in their most recent results. Seven saw their profit figures fall and four made a pre-tax loss.

One of the worst-hit was McCarthy & Stone, whose latest figures are for the year to October 2020. McCarthy & Stone specialises exclusively in building and managing retirement housing. It was hit particularly badly by the pandemic, with the high average age of its buyers seemingly making them more reluctant to return to the market after restrictions were eased in May.

Revenue for the year to October fell 73%, from £725m to just £197m. The company made a pre-tax loss of £153m, compared to a profit of £43m the previous year. In November, the company said that the second wave of the pandemic was again depressing sales.

In January 2021, McCarthy & Stone was bought out for £647m by US private equity group Lone Star (which also owns property developer Quintain).

That same month the government announced that it was introducing legislation to stop the abuse of inflationary ground rents on most new homes – bad news for retirement house-builders like McCarthy & Stone, who rely on ground rent charges to offset the high running cost of developments, which typically include a large amount of communal space.

The UK’s house-building industry has long been the target of criticism for its willingness to make big profits while apparently unable to deliver enough new homes to meet the nation’s needs. That criticism is unlikely to go away any time soon.

The Covid-19 pandemic hit the house-building sector harder than most and the number of completions has fallen substantially. In 2019 approximately 240,000 new homes were built in the UK; in 2020 this fell to around 200,000.

Savills, the estate agent, estimated that only around 180,000 homes will be built in 2021 and that the volume of houses being built will not return to pre-pandemic levels until 2026. Even then, the number will still be 20% less than the government’s target of 300,000 houses a year.

And it is not just Covid that is to blame. According to Savills, the number of houses being built was already decreasing when the pandemic hit in March 2020.

Got a story? Email news@theconstructionindex.co.uk