The consumption of constructional steelwork in 2023 was 893,000 tonnes, a decrease of 1% on 2022.

Overall, the total UK structural steelwork market is expected to reduce to 873,000 tonnes by 2026, with a decline in industrial sheds and offices during 2024 and 2025 making the most significant contribution.

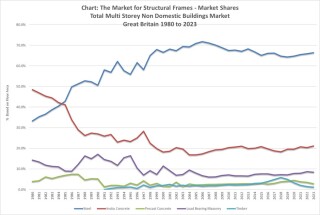

Despite that, the BCSA says that steel still remains the material of choice for construction, accounting for 48.6% of framing material used in 2023. [See graph below.]

In 2023 the consumption of structural steelwork in industrial buildings increased by 2.2% to 450,000 tonnes, but is forecast to fall in 2024 before seeing an upward trend in 2025 and 2026. There are some major gigafactory projects in the pipeline, which could fall in 2025 and 2026 having a significantly positive impact on the current forecast.

The consumption figure for offices rose by 9.1% to 107,000 tonnes in 2023, but is forecast fall back by 14% in 2024 before levelling out in 2025 and 2026. The offices market recovered strongly post-pandemic and has seen three consecutive years of growth. However, the new order figures tailed off during 2023 we think primarily due to the economic uncertainty. It is felt post-election there may be more confidence and this sector may pick up again.

According to BCSA chief executive David Moore, key growth sectors for structural steelwork in 2023 are limited as the post-pandemic recovery is over and the recent economic turmoil, rising energy costs and higher interest rates have put the brakes on the UK economy. Nevertheless, online retail is not going away, and attractive office space will still be required even for hybrid working, so demand for industrial sheds and office buildings should stabilise soon, he reckons.

Also, the long-promised investment in new hospitals, schools and low carbon energy production should create further opportunities for the steel construction sector.

David Moore said: “This forecast shows the recovery from the Covid-19 pandemic is complete and that the market is levelling off in the short term. Nevertheless, with steel construction best-placed to support the key logistics sector and city centre office refurbishments, we are hopeful of maintaining a healthy market for our steelwork contractor members despite the uncertain times ahead.”

Got a story? Email news@theconstructionindex.co.uk

.png)