The demolition sector’s last bumper year is now a rapidly-fading memory. Two years ago everything looked set for vigorous growth, with overall turnover and pre-tax profits surging ahead. Then the wet blanket of Brexit uncertainty descended and revenue growth ground to a halt. Last year the average turnover of the 20 leading contractors barely grew at all – and profitability slumped.

Things are better this year – but not much better.

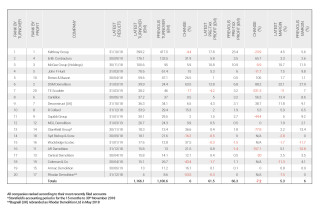

Total turnover for the top 20 demolition firms grew by 6%, from £1.1bn to around £1.2bn but overall pre-tax profit fell by just over 7% to £61.5m. This is the second year in a row that profits have taken a tumble in the sector. In 2018 we recorded pre-tax profits of almost £77m for the same 20 contractors.

Average profit margins have also fallen: two years ago, the average pre-tax profit margin was 7.2%; this year it’s 5.3%.

Keltbray remains the undeniable giant of the industry with annual turnover of almost £400m for the year to October 2018, more than twice that of second-placed Erith Contractors.

Keltbray is one of the world’s biggest demolition specialists but it saw both turnover and profit fall during the trading period. Turnover of £399.2m was about 4.5% lower than the previous year (£417.5m) and pre-tax profit was down almost 24% at £17.8m (2017: £23.4m).

The board nevertheless offered an upbeat assessment of the company’s progress: “Against a backdrop of a reduction in activity in the Group’s core sectors, it was pleasing to note that the impact was a modestly reducing turnover and gross profit levels [while] retaining a significant cash position”.

As Keltbray has grown, it has diversified into new areas and is no longer purely a demolition specialist. It now separates its activities into three complementary categories: Specialist Contracting Services (demolition, geotechnical, concrete structures, asbestos removal, soil remediation etc.), Infrastructure (trackworks, plant hire, power transmission and general civil engineering) and finally Group Services (labour agency hire, training etc).

The first of these three categories remains Keltbray’s core focus and the firm is proud that it can offer “an integrated, entirely in-house solution”. For the year to October 2018, this division won new work “in line with turnover”, said Keltbray, “but it is expected that the D&C [Demolition and Civil Engineering] business unit turnover will reduce again in 2019, primarily due to a slowing in new early-works opportunities.

“This reduction will be more than offset by an increase in turnover for Keltbray Structures Ltd, the reinforced concrete frame business,” said the company.

In the notes accompanying its latest figures at Companies House, Erith Contractors, the UK’s second-largest demolition contractor, acknowledges “a challenging economic climate” and observes that “the market for demolition remains highly competitive with both smaller businesses fostering strong local reputations and larger PLCs competing on price”.

Despite this, Erith doesn’t appear to be struggling unduly. In the 12 months to 30th September 2019, the company turned over £176.1m, about 30% more than its previous year’s turnover of £133.5m. Furthermore, pre-tax profit rose from £3.5m in 2018 to £5.8m in 2019.

Also producing a solid set of results, Birmingham-based DSM Demolition (number six on our table) increased its turnover figure from £24.4m to £39.9m in the year to 31st March 2019. Pre-tax profit rose from £6.8m to £12.8m – an increase of almost 90%. DSM also boasts the biggest pre-tax profit margin of our selection at over 32%.

In 2017, DSM Demolition – then one of the UK’s largest family-owned demolition specialists – was sold by the Kelly family to a management team backed by investor Metric Capital Partners. The deal, believed to be worth around £100m, rolled DSM Demolition and its sister company – brownfield land developer St Francis Group – into one business.

In its latest set of results, DSM Demolition notes that “the business has achieved a good level of turnover and high profit level. The Directors are satisfied with the year’s financial results and are forecasting a similar level of turnover for the forthcoming year [2019/20], underpinned by an excellent order book.”

Last year’s analysis showed that four of the top 20 demolition contractors made a loss before tax, though none of them were deeply in the red. This year the situation is similar, though marginally worse. The biggest loss-maker is Wembley-based TC Scudder, which is part of the Carey Group.

Scudder reported revenue of £38.2m in the year ending March 2019, down 17% from the previous year’s figure of £46m. But its 2018 pre-tax profit figure of £3.2m was replaced by £4.2m-worth of pre-tax losses.

“Losses recorded in this financial year are attributable to the performance of four demolition contracts which were cautiously valued and are now substantially complete,” explained the company.

“We are now committed to working with each client to recover our full entitlement through the mechanisms of the contract and expect to close out these issues and see Scudder Demolition return to gross profit in 2019/20,” said the firm.

Wooldridge Ecotec is the only company in our table to have recorded pre-tax losses for the past two consecutive periods. The good news is that the business grew its turnover from £12.8m in 2017 to £17.6m in the year to January 2019. And its pre-tax loss was reduced from £1.5m to a mere £0.3m.

Ecotec’s business is split into three divisions – demolition, bulk earthmoving and waste handling – and, of these, the demolition division is the best-performing. It accounted for revenues of over £12.5m last year, up from £7m the year before.

“The directors are disappointed with the overall results for the year, but are pleased with the improved performance of the demolition division which has increased turnover considerably whilst reporting good growth margins on individual sites,” declared the company.

For the past two or three years, construction companies have been noting the negative impact on their financial performance of the ‘uncertainty’ surrounding the UK’s agonisingly slow departure from the European Union. And, of course, all the figures in the table below predate 31st January 2020, when Brexit finally became a reality.

Most of these companies will have been hoping that, now the UK has officially left the EU, all the uncertainty that inhibited spending and delayed contracts would now have been laid to rest and the UK would be busy ‘taking back control’ and building up the economy.

But who cares about Brexit now? In the space of just a few weeks, a microscopic virus has thrown a gargantuan spanner into the works of the global economy. Now there’s even more uncertainty to worry about.

This article was first published in the April 2020 issue of The Construction Index Magazine

UK readers can have their own copy of the magazine, in real paper, posted through their letterbox each month by taking out an annual subscription. Click for details.

Got a story? Email news@theconstructionindex.co.uk