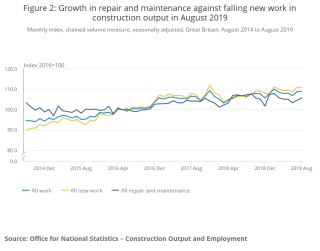

For new work, the sector experienced a mixed profile of growth, with private commercial new work (1.0%), public new housing (3.3%) and private industrial (3.8%) experiencing increases whereas private new housing (-0.9%), infrastructure (-1.3%) and public other new work (-3.1%) saw falls.

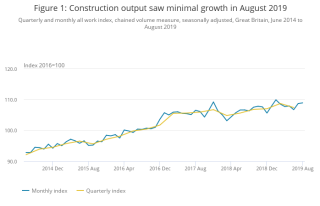

According to the latest bulletin from the Office for National Statistics, for the three months June to August 2019, construction output increased by 0.1%, driven by a rise in new work of 0.5% but offset by a fall in repair and maintenance of 0.8%.

Since the record high of £13,869m recorded in February 2019, the industry has seen falls in March, April and June but increases in May, July and August. The level of construction output in August 2019 is now £123m below this record high.

Industry comment

Commenting on the numbers, Cruden Group chief executive Kevin Reid said: “The overall impact of Brexit, in whatever guise, remains to be seen. However, fundamental change may be slower than perhaps anticipated – other than price inflation and reduced availability of materials sourced from the EU, which the industry is currently experiencing. This is a significant issue for the sector, as will be any resulting downward trend in labour resources.

“Despite these challenges, at Cruden we have secured a strong pipeline of activity up to March 2021 and a growing order book beyond that… Overall, we remain cautiously optimistic about the year ahead, despite the significant economic uncertainties that lie ahead.”

Redrow chief operating officer Matthew Pratt said: “It’s disappointing to see output in new private housing down on the month across the industry – particularly as this is not something that we’re seeing at Redrow. Month-on-month figures can however be volatile and it is perhaps more encouraging to see a strong uplift in the annual figures which registered a rise of 4% year-on-year. Today’s data indicates that despite Brexit uncertainty, house-builders are actively delivering more homes across the country to help meet demand and fulfil the government’s housebuilding target.

“While Brexit continues to be the main priority for Boris Johnson, we are hopeful that matters related to housing will be addressed within the Queen’s Speech on Monday and that we may have some clarity on support for the sector. To ensure the economy remains as strong as possible after we leave the EU, the housing market must be high on the government’s agenda and we absolutely don’t want to see today’s monthly decline continue in future months.”

Clive Docwra, managing director of construction consultant McBains, said: “These latest figures show minimal growth overall but no-one in the industry will be getting too excited. The trends show that the industry is experiencing a mixed profile of monthly growth, with falls in March, April and June largely offset by increases in May, July and August. There was also a month-on-month decrease in new work of 0.2% in August.

“This fall in new work reflects the industry being at a crossroads as the Brexit situation remains unclear, with the longer-term picture one of investor restraint and a weakness in the housing market translating into a fall in the numbers of homes.”

Gareth Belsham, director of surveyors Naismiths, said: “The see-sawing has finally settled into stagnation. The construction sector is back into a holding pattern – with overall output flat and the growth in new work cancelling out the fall in repair and maintenance jobs. But beneath the benign surface, sentiment is increasingly resting on a knife-edge. A Brexit deal – any Brexit deal – could uncork months of repressed demand and send output racing back up to more normal levels. But a chaotic ‘no-deal’ exit, or even an extension to the agonising limbo, could lead to the plug being pulled on deferred projects.

“With contractors’ order books getting thinner by the month, this is depressing tender prices as firms bid ever lower for work. Builders are seeing their margins eroded to dangerously low levels as material and labour costs continue to ratchet up – driving a steady stream of contractors to the wall.

“While the construction sector is adept at riding out peaks and troughs in demand, the worry is that the longer the crushing uncertainty goes on, the harder it will get for it to respond when the recovery eventually comes.”

Got a story? Email news@theconstructionindex.co.uk