But with data distorted by the continuing post-pandemic rebound and February storms – and with the UK economy now facing headwinds – all may not be quite as grand as the ONS report suggests.

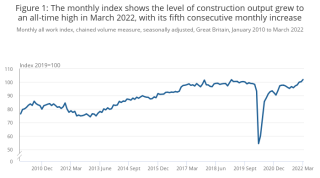

Construction output increased by 1.7% in volume terms in March 2022 compared to February. This is the fifth consecutive monthly growth and a record high (£14,994m) since monthly records began in January 2010.

For the first quarter of 2022, construction output rose by 3.8%. Excluding the immediate post-Covid rebound, this is the strongest quarterly growth since the 3.9% seen in the first quarter of 2017.

The increase in monthly construction output in March 2022 was driven by increases seen in both repair & maintenance (3.0%) and new work (1.0%); At the sector level, private housing repair & maintenance (5.8%) and private commercial new work (4.0%) were the main contributors to the monthly increase.

Anecdotal evidence suggests that mid-February storms (Dudley, Eunice and Franklin) generated a lot of repair work through March and also stifled some construction work in February. March was a month of fixings things and catching up.

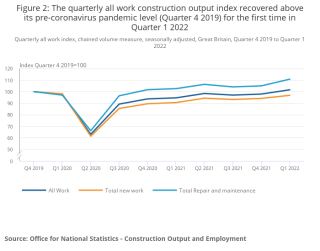

The level of construction output in March 2022 was 3.7% (£539m) above the February 2020 pre-coronavirus pandemic level; new work was 1.6% (£148m) below the February 2020 level, while repair & maintenance work was 13.8% (£687m) above the February 2020 level.

Total construction new orders decreased by 2.6% (£346m) in Quarter 1 2022 compared with Q4 2021; despite this quarterly fall, all sectors are still above their pre-coronavirus pandemic level (Q4 2019).

The annual rate of construction output price growth was 7.3% in the 12 months to March 2022. This was the strongest annual rate since records began in 2014.

The Construction Products Association said last week the growth of the repair & maintenance was unlikely to continue, given rising inflation, rising interest rates and a growing cost of living crisis. The private housing repair, maintenance and improvement (RMI) market boomed after the pandemic took hold and the nation spent more time at home. But it is now the sector arguably most exposed to price inflation, falls in consumer confidence and pressures on household incomes. Overall, output is expected to fall by 3% in 2022 and 4% next year from the current all-time high, the CPA said.

Clive Docwra, managing director of property and construction consultant McBains, said of the latest ONS report: “Today’s figures show that the industry rallied in March, in part due to new orders coming in from pent-up demand left over from the pre-pandemic period. However, inflationary pressures are beginning to bite hard, with interest rate rises, the war in Ukraine and the rising cost of materials contributing to uncertainty about the future.

“March’s increase in output was helped by the return to work of offices, as demand for refurbishments increased. The increase was also propped up by repair work due to the previous month’s storms. Other work areas are less robust, however. The cost of living crisis means the private housing sector is particularly at risk, as steep falls in disposable incomes will translate into less demand for new homes.

“The wider longer-term picture is a concern, as total new orders fell by 2.6% in the first quarter of 2022 compared to the last quarter of 2021.”

However, Gareth Belsham, director of the property consultant and surveyors Naismiths, was altogether more optimistic. He said: “After February’s wobble, construction output snapped back into growth territory in March, to hit £15bn for the month – its highest ever level. But today’s data is both a win and a worry for what’s long been seen as the most volatile sector of the UK economy.

“After building up a huge head of steam last year, momentum is still strong – and the construction industry expanded by an impressive 3.8% in the first quarter of 2022.

“In March it had the honour of being the only major sector of the economy to be expanding, and total output is now comfortably above its pre-pandemic level.

“But such rapid growth in the face of widespread supply problems is extracting a high inflationary price. With the prices of building materials, labour and transport costs all soaring, the annual rate of output price inflation hit 7.3%in March, its highest level since records began.

“And despite all the heat in the market, the pipeline of new work is starting to slow. New orders fell by 2.6% in the first three months of the year compared to the final quarter of 2021.

“While this is disappointing, it’s far from a disaster. The final months of 2021 saw a huge 9.2% jump in new orders, so the current slowdown only looks bad compared to that.

“Most building firms remain extremely busy right now, and their order books for the coming months are reassuringly full.

“Nevertheless the war in Ukraine has disrupted the supply of key building materials including steel and timber, bringing the unwelcome return of shortages and triggering a new wave of cost inflation.

“Yet sentiment remains largely positive and the market is more free-flowing than it was. Having showed incredible resilience in the way it dealt with the pandemic and then the post-pandemic supply problems, construction is adapting well to this latest challenge.”

Got a story? Email news@theconstructionindex.co.uk