The site preparation and earthmoving sector should be riding high at the moment. In defiance of the Covid pandemic and widespread supply-chain disruption, the most recent construction output figures from the Office for National Statistics (ONS), published in February, show that for 2021 as a whole, annual construction output increased by a record 12.7% compared with 2020.

Admittedly, 2020 was a particularly bad year. The whole industry was put into near-total lockdown for several weeks in the spring, resulting in an almost 15% drop in construction output.

This article was first published in the March 2022 issue of The Construction Index Magazine. Sign up online

But by the fourth quarter of 2021, order books started filling up again. And infrastructure and house-building were the only sectors where the level of output in December 2021 was above their pre-Covid February 2020 level.

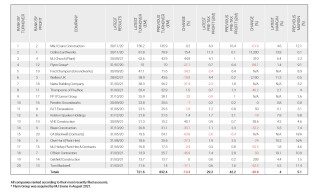

Any upswing is sorely needed by earthmoving contractors if our analysis of the top 20 companies in the sector is anything to go by. Total revenues for these companies has fallen by more than 10% for the second year running and pre-tax profits have declined by a third – again, for the second year running.

Our review of the sector is based on each company’s latest accounts filed at Companies House and these figures relate to a period from May 2019 to September 2021, meaning that all are affected to a greater or lesser degree by the pandemic.

Overall turnover was £722m, down 13.3% from last year’s £832m; pre-tax profit fell by 30.8% to £29.2m (2021: £42.2m).

Thirteen of our 20 companies saw their turnover figure fall last year, and of the 16 that reported a profit before tax, eight saw that profit figure also fall.

Just about everybody, in their annual report, acknowledges the challenges thrown up by Covid-19, but while several report less-than-sparkling progress as a consequence, others can point to positive outcomes despite the pandemic.

M&J Evans remains bullish and is still the largest of our 20 companies by turnover. The company’s turnover has barely changed since last year – up by a slender 0.2% to £136.2m this year. But pre-tax profit is down from £16.4m to £6.4m this year, a drop of almost 17%. A pre-tax profit margin of 4.6% is still respectable in this industry, though.

M&J Evans’ figures are for the year to November 2020, and so encompass the most severe of the Covid lockdowns.

“Whilst profit has fallen, it is against the backdrop of a global pandemic which led to a temporary cessation of activity for the company, followed by a gradual return to normal levels of business,” said chief executive Chris Southgate.

Since publishing its latest results, M&J Evans’ dominant position in the sector has been significantly bolstered by the acquisition, in August last year, of major competitor Wiltshire-based Flynn Group – currently occupying fourth place on our table of top 20 earthmovers.

Operating almost exclusively in the south and south-west, Flynn is heavily dependent on the house-building industry and was hit hard by the Covid lockdowns of 2020.

“The group has seen a reduction in turnover and a significant reduction in profits as a result of the outbreak of the Covid-19 pandemic during the year,” says the company’s latest annual report.

“Business within the main trading company, Flynn Limited, shut down completely for the entire month of April [2020],” it adds.

This article was first published in the March 2022 issue of The Construction Index Magazine. Sign up online

The reliance on house-building means that the company is “somewhat dependent on the confidence of the consumer, which in turn is a major factor in its client’s sales hence enquiries and orders to ourselves. These influences are outside of the group’s control,” observes the company.

Flynn’s turnover in the year to July 2020 was £51m, down 27% from £70m the previous year. Pre-tax profit fell from £6.4m to £0.7m.

In August 2021, a little over four months after it published these results, Flynn was bought out by M&J Evans and its head office relocated to Walsall, where Evans is based. Managing director Alf Hambidge stayed with the business and has joined the senior management team at M&J Evans.

The acquisition was brokered by corporate consultant Transcend on Flynn’s behalf. “Having successfully grown Flynn during the period of our ownership, we wanted to find the right buyer for our business,” explained Bill Hall, a major Flynn shareholder.

“We look forward to watching Flynn continue to flourish as part of the enlarged M&J Evans Group,” he added.

Just above Flynn Group, at number three on our table is another Wiltshire-based company, MJ Church, which enjoyed a successful 12 months to September 2021.

Turnover was up 45% from £43.9m to £63.6m and pre-tax profit rose from £1m to £4.1m last year. Although the third lockdown in November 2020 and subsequent Covid restrictions continued to affect business into 2021, MJ Church says that the impact was less pronounced than previously. The availability of government assistance – the furlough scheme, VAT deferral and time to pay – helped the business cope with the ‘peaks and troughs’.

The company says that its contracting division “had a good year, with sales exceeding pre-pandemic levels. The division had sales of £38m in the year with National Highways framework agreements accounting for more that 50% of the turnover.”

This year looks promising too: “We have a strong contracting pipeline, securing the SDF south-east & south-west contract with National Highways and an earthworks framework that shall see us working in three geographic locations. Both these framework contracts will provide work for the next five years and will utilise the full range of our services,” said the company.

Occupying second place on our table, and with the largest pre-tax profit margin, Derbyshire-based Collins Earthworks fared remarkably well in the year to 30th November 2020, despite the directors having been “under immense pressure from the Covid pandemic”.

Turnover was up 15.4% to £81.8m (2019: £70.9) and pre-tax profit hit £11.3m. The previous year, Collins made a pre-tax profit of only £100,000.

Collins’ recent success is undoubtedly thanks to having won some major infrastructure contracts. It is currently employed by HS2’s main works contractor, BBV Joint Venture (comprising Balfour Beatty and Vinci Construction).

The company has been working on HS2 since April 2020 and last year it mobilised a team of 120 operatives and 35 machines to remove 300,000m3 of soil from the north portal site of the Long Itchington Wood Tunnel in Warwickshire.

Collins Earthworks chief executive David Collins said: “Working on HS2 has provided our business with ongoing work through the pandemic, ensuring we can continue to support jobs for our 370 employees in the Midlands.”

Also prospering from ongoing work from HS2 is Welsh earthmover Walters UK.

Now at number six on our table, Walters saw turnover fall back in the year to February 2021, from £43m to £38.9m, a drop of about 10%. But pre-tax profits increased from a slim £100,000 to a satisfying £4.1m over the same period.

“Regionally the company continues to increase its market share of civil engineering and road network improvement opportunities,” reports the company.

“This includes works direct for local authorities, Welsh government, National Resources Wales and local regional frameworks across Wales the south-west of England.

“Nationally the company has now successfully begun its major section of High Speed 2 works, with this contract continuing for the next four years,” says the company.

While individual companies are clearly steering a steady course, the continued downward trend in turnover and profitability suggests that life, post-Brexit and post-Covid, is becoming more challenging for UK contractors in general.

Many of the companies on our table report significant investments in plant and equipment over the past couple of years, not just to maintain a modern fleet but also to gear up for future contracts. However, rising costs – particularly fuel costs – will continue to test this sector’s resilience.

This article was first published in the March 2022 issue of The Construction Index Magazine. Sign up online

Got a story? Email news@theconstructionindex.co.uk