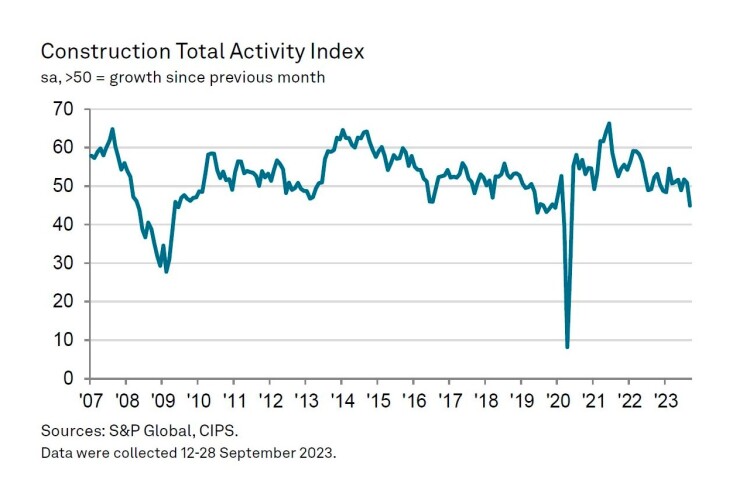

The headline S&P Global / CIPS UK Construction Purchasing Managers’ Index (PMI) for September 2023 registered 45.0 – down from 50.8 in August.

The construction PMI, based on monthly surveys of purchasing managers, is a seasonally adjusted index tracking changes in total industry activity. Any score above 50 indicates growth, below 50 shows activity slowing.

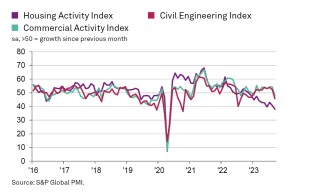

All three main segments of construction work posted a reduction in business activity in September, led by a steep and accelerated fall in house-building (scoring 38.1), followed by civil engineering activity (45.7). Aside from the pandemic, the latest fall in housing activity was the steepest since April 2009.

Survey respondents widely commented on cutbacks to house-building projects amid rising borrowing costs and weak demand conditions.

Commercial building declined at a more modest pace in September (index at 47.7), but this comes after some solid growth seen throughout the summer. Some firms noted that worries about the economic outlook had dampened client demand and led to a lack of new work to replace completed projects.

Total new business received by construction companies decreased for the third time in the past four months, with the rate of decline its steepest seen since May 2020. Construction companies typically cited sluggish demand conditions and a severe drag on new orders from reduced workloads in the house-building sector.

Slowing activity inevitably means other indicators improve: subcontractor availability is better and delivery times for construction products and materials have now shortened in each of the past seven months. Similarly, after high input price inflation in the first half of 2023, cost burdens were broadly unchanged in September. Survey respondents noted higher fuel bills and some rises in raw material prices, but this was offset by lower shipping costs and greater price competition among suppliers.

The number of construction firms predicting a rise in output over the year ahead (41%) continued to exceed those forecasting a decline (17%). This was linked to long-term business expansion plans and hopes of a turnaround in customer demand. However, the overall degree of confidence slipped to its lowest since December 2022 amid concerns about higher borrowing costs and weaker housing market conditions. And this display of confidence came from a survey conducted before the cancellation of the northern leg of HS2, which has doubtless done little to raise spirits across the industry

Tim Moore, economics director at S&P Global Market Intelligence, which compiles the survey, said: "Output levels declined across the UK construction sector for the first time in three months during September and the latest downturn marked the worst overall performance since the early stages of the pandemic.

"A rapid decline in house building activity acted as a major drag on workloads, with construction companies widely commenting on cutbacks to new residential development projects in the wake of sluggish demand and rising borrowing costs. Concerns about the domestic economic outlook also dampened client spending during September, which contributed to the fastest reduction in commercial building since January 2021.

"The survey's forward-looking measures once again remained relatively downbeat as order books decreased at an accelerated pace and business activity expectations eased to the lowest so far this year. Moreover, fewer project starts meant that sub-contractor availability increased to the greatest extent since the summer of 2009.

"Lower demand across the supply chain contributed to a robust improvement in delivery times for construction productions and materials, alongside a stabilisation in purchasing costs during September."

John Glen, chief economist at the Chartered Institute of Procurement & Supply (CIPS), said: “The impact of high mortgage rates and low house buying demand continues to flow through the supply chain and negatively hit the UK construction industry. It has been a tough year for residential construction and the sharp decline in September shows the pressure on the sector is still a long way from easing, despite the pause on the raising of interest rates.

“After some positive signs over the summer months, September saw a bump back down to earth for commercial construction as concerns over the future of the economy hampered demand and delayed new projects.

“There is some comfort in the fact that the days of disrupted supply chains and soaring inflation are behind us for the time being, with delivery times continuing to fall and input prices remaining stable. The lack of activity has given space for suppliers to catch up with demand and create slack in the supply chain, which the construction sector will be hoping to take advantage of once demand returns.”

Fraser Johns, finance director at Beard Construction, said: “After three months of growth and many positive signs for the sector, today’s news is another reminder that we’re not out of the woods just yet. The continued downturn in house-building amid low demand and higher borrowing costs is once again having a significant impact on the wider industry picture.

“Away from house-building and on the ground at Beard, we have seen positive signs of demand, along with a number of starts on site in September - particularly in education and for local infrastructure projects across our four regions. Frameworks continue to provide valuable opportunities and fill our future pipeline, highlighting a contrast in appetite and demand across different sectors.

“There’s no question many will be encouraged by the continued easing of inflation and the news of a hold on interest rates. However, we cannot escape the fact that there is still much volatility in the sector and in the wider economy. After months of propping up the industry, commercial construction has shown it’s not immune from macro pressures. For those contractors facing real pressure, now is the opportunity to take advantage of the breathing space offered by a drop in activity to get all their ducks in a row and evaluate where their efforts are best placed – particularly those with a focus on residential development.”

Got a story? Email news@theconstructionindex.co.uk