The Construction Backlog Indicator (CBI) from Associated Builders & Contractors (ABC) reports a dip from 7.8 months to 7.4 months, though the figures are slightly higher than the first quarter of 2011.

The CBI measures the amount of construction work under contract to be completed in the future.

“On the heels of a mixed bag of national economic news, CBI declined for the second quarter in a row,” said ABC chief economist Anirban Basu. “The lull in non-residential construction momentum is not poised to end in the immediate term. The nation’s non-residential construction activity will remain soft during the summer months, with flat to declining non-residential construction spending. The ongoing instability in the nation’s nonresidential construction industry appears to be related to the period of economic weakness that developed in the broader economy last year, as well as concerns regarding export growth due to recessionary forces in Europe. The result is that many prospective construction projects were cancelled or postponed.”

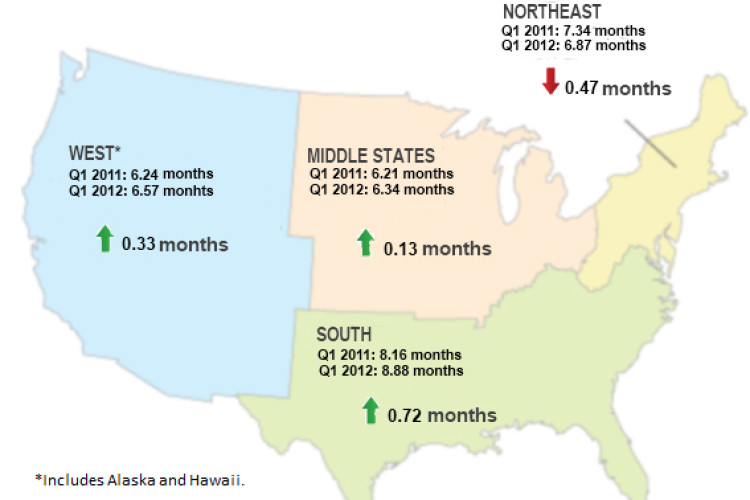

Compared to the first quarter of 2011, construction backlog is slightly higher in every region with the exception of the northeast. In the west, construction backlog expanded by 0.46 months from the fourth quarter of 2011 to the first quarter of this year. The middle states have the shortest backlog at 6.34 months and the south continues to register the lengthiest backlog at 8.88 months.

“The south, which includes a number of rapidly expanding, commodity rich states, continues to be the top performer in terms of producing new opportunities for contractors,” said Basu. “Though average construction backlog in the south was roughly flat during the past quarter, backlog is up by seven-tenths of a month from one year ago. No other region has generated an increase in backlog that large.

“Construction backlog expansion in the Middle States continues to be stifled,” he said. “Gains in industrial production have been sporadic during the past year – too scattered to induce the next wave of manufacturing-related construction projects. In addition, average construction backlog in the Northeast has fallen on a year-over-year basis. Last year’s soft patch, including the economic weakness associated with the debt ceiling issue, appears to have impacted the financial institution-rich Northeast more than other region.”

Average construction backlog in the infrastructure category is nearly two months lower than the third quarter of 2009, when a growing number of stimulus-related projects were beginning to move from planning to implementation, Basu said. “Based on the latest backlog data, infrastructure spending is likely to remain flat for the balance of the year.”

Construction backlog for mid-sized firms with annual revenue between US$30m and $50m (£18.6m and £31m) expanded substantially, rising nearly two months during the first quarter. Construction backlog declined for firms with less than US$30m in annual revenue to an average of 6.72 months. Those with annual revenues in excess of US$50m have not experienced backlog expansion during the past year.

“The rebound in commercial construction appears to have positively impacted contractors in the US$30 million to US$50 million revenue category,” said Basu. “This segment should continue to experience rising construction backlog due to the momentum in this construction industry sector.

“On the other hand, firms with revenues in excess of US$50m have not been able to progress substantially in construction backlog during the past year,” he said. “This is primarily due to stagnant backlog in the heavy industry and infrastructure categories, two construction sectors with which many large firms are closely affiliated.”

Got a story? Email news@theconstructionindex.co.uk