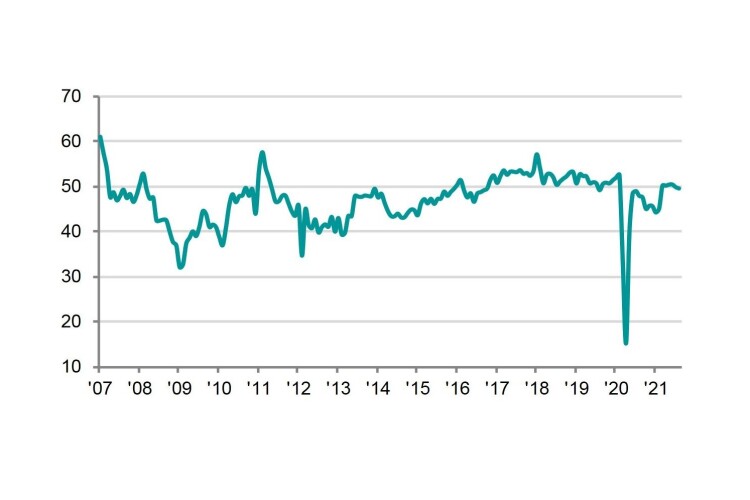

Cost burdens have risen rapidly amid severe supply-chain disruption and confidence about the 12-month outlook has weakened, according to the latest IHS Markit Eurozone Construction Purchasing Managers’ Index (PMI).

The index IHS Markit from responses to questionnaires sent to purchasing managers in a panel of about 650 construction firms in the eurozone. The headline figure is the total activity index, which tracks changes in the total volume of construction activity compared with one month previously. The index fell slightly from 49.8 in July to 49.5 in August, signalling a second successive decline in activity. While only marginal overall, the rate of reduction quickened from that seen in the previous survey period.

Where a decrease was reported, companies linked this to raw material and labour shortages, which disrupted activity on site. Firms also noted that activity was constrained by rising input prices. Underlying data indicated sharper contractions in both commercial and civil engineering activity.

Meanwhile, house-building work rose at the quickest pace since May. August survey data pointed to a sustained expansion in home-building activity across the eurozone, stretching the current period of growth to six months. The rate of increase quickened from the previous survey period. Italian constructors led the upturn with the strongest expansion on record. However, German companies reported a fall in activity for the first time in three months, while French firms noted a third successive decline.

Commercial building activity fell for the eighteenth consecutive month during August, with the rate of decline quickening to the sharpest since April. A marked decline in Germany and a second successive fall in France offset a record expansion at Italian commercial constructors.

Work undertaken on civil engineering projects decreased again in August, extending the current sequence of decline to 25 months. Notably, the pace of contraction was the quickest since February. Construction firms in France and Germany recorded a further sharp fall in infrastructure activity, while Italian firms signalled the strongest rise since September 2018.

Usamah Bhatti, economist at IHS Markit, said: “The downturn in the eurozone construction sector extended into its second month in August, as businesses reported a slightly quicker fall in activity. Positively, growth in new business inflows resumed, albeit at a marginal pace, marking the third rise in new orders in four months. That said, firms continued to report widespread shortages of raw materials and labour across the bloc and beyond, which placed ever-increasing strain on supply chains and cost burdens. The rate of input price inflation softened from July's peak, but remained among the strongest seen since the series began in January 2000. Increased headwinds, notably from local and global supply chains, dampened business confidence.

.png)

“The degree of optimism eased to the softest since May. At the national level, only Italian frms indicated a rise in activity, and one that was the fastest on record. Yet this was offset by sustained declines in Germany and France.”

The fall in total eurozone construction activity was led by sharp and accelerated declines among French and German companies, which offset a series-record upturn in construction output in Italy.

New orders placed with eurozone construction companies returned to growth in August. The rate of expansion was only marginal, and the third instance of growth in the past four months. Anecdotal evidence suggested that new projects coming to tender and government incentives for the sector led to a rise in new order inflows, though demand was slightly dampened by capacity constraints. Italian firms saw a record increase in new orders, however this was partially offset by a steep decline in Germany. French firms saw a softer and only moderate fall in new business.

Vendor performance across the eurozone construction sector worsened markedly in August. Average lead times lengthened in all three of the bloc's largest members, with German firms pointing to the most severe deterioration. That said, the extent of delays was softer than those seen in the second quarter of 2021. Firms overwhelmingly attributed longer lead times to raw material shortages and supply bottlenecks.

Latest data showed a sustained and rapid rise in input costs faced by eurozone construction firms. The rate of inflation softened from July's series record, though remained among the steepest seen since aggregate data became available in January 2000.

A majority of panel members cited higher raw material prices due to widespread shortages among suppliers. Underlying data indicated robust rises in cost burdens at French and German firms, with the rise in Italy the second-fastest on record.

Eurozone construction firms expressed optimism regarding the 12-month outlook for the eighth time in a row in August. That said, the level of positive sentiment fell to a three-month low.

Got a story? Email news@theconstructionindex.co.uk