While the wider construction industry seems determined to confound the economic pessimists by growing steadily, house-building (the industry’s star performer for the past six years) is beginning to show signs of fatigue.

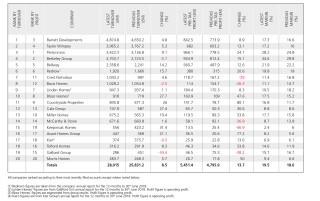

It must be said that our analysis of the 20 biggest private house-building firms doesn’t paint a picture of a sector in crisis. Overall revenues and pre-tax profits continue to grow, and profit margins are still of a magnitude that most businesses in other sectors can only dream of.

But there are signs that the house-building gravy train is slowing down.

Growth has certainly slowed. Last year’s Top 20 house-builders delivered a 16.3% increase in turnover compared to the previous year, and overall pre-tax profits were up almost 25%. This year both turnover and profit have increased again, but by only 8.5% and 13.7% respectively.

However the sector’s profit margin remains virtually unchanged at about 19.5% - not at all bad compared with this year’s Construction Index Top 100 construction industry average of 2.5%.

The changes taking place in the house-building market are subtle and do not amount to grounds for concern but there can be no doubt that house-building has lost some of the sparkle that has characterised it over recent years.

Growth through 2014/15 was especially vigorous – far more so than most had expected – with collective turnover growing by 25% and profits surging by 50%.

A significant factor in this leap forward was the introduction in 2013 of the government’s Help to Buy initiative. Not only did Help to Buy stimulate first-time buyers and boost the number of property transactions; it also helped to inflate house prices, an unintended consequence that drew widespread criticism from organisations including the Institute of Directors, the Royal Institution of Chartered Surveyors and the International Monetary Fund.

Help to Buy proved to be especially helpful to the house-builders themselves, as recent revelations at Persimmon have demonstrated. Persimmon is the UK’s third-largest house-builder and, as our analysis shows, its most profitable, boasting a margin of 28.2% after making a pre-tax profit of £966.1m on turnover of £3.24bn in the year ending 31st December 2017.

The company’s long-term incentive scheme, introduced in 2012, deposited hundreds of millions of pounds-worth of bonuses into the bank accounts of its top executives and left egg on the faces of the shareholders who had approved the scheme. Embarrassed, the company sacked its CEO Jeff Fairbairn last month, explaining – bizarrely – that his £75m bonus had rendered him incapable of continuing in his job.

With one or two isolated exceptions, every one of the Top 20 house-builders has seen turnover increase year-on-year since 2013. But this year, for the first time, four companies have recorded a fall in revenues while five have seen pre-tax profits also fall.

Despite giving away hundreds of millions to a handful of senior managers, Persimmon remains in rude health and retains its number three position in our table of top house-builders.

First and second place also remain occupied by the same incumbents: Barratt Developments and Taylor Wimpey respectively. Both have seen turnover increase by roughly 5% over the past 18 months with Barratt’s revenues now nudging £5bn and Taylor Wimpey about to break through the £4bn threshold.

Berkeley Group also holds fast to the number four position and, as previously, boasts the highest profit margin, at 34.6%, of the top 20. Berkeley’s pre-tax profits grew by over 15%, from £812m to £935m, in the 12 months to May 2018, but it was one of the four companies in the table to see turnover decline – albeit by a narrow margin of 0.7%.

Berkeley sold 3,536 homes last year, down from 3,905 the year before, but house-price inflation meant that the average selling price had increased from £675,000 to £715,000 in the space of a year. In his statement, chairman Tony Pidgley notes government figures showing that completions grew by 16% in 2017 and starts by 5%.

But he also notes that, in London, starts were 30% lower than in 2016 and that “some funders and builders are choosing to exit the market when faced with the degree of risk and regulation that now confronts development in the Capital.”

.png)

Sector leader Barratt – which celebrated its 60th birthday this year – put in a solid performance during the 12 months to June 2018 with record turnover and pre-tax profits of £842.5m. Chief executive David Thomas congratulated the business on “building the homes the country desperately needs, creating jobs and supporting economic growth whilst also delivering both operationally and financially for our shareholders.”

Despite Barratt’s upbeat market summary, there are undeniable signs of cooling-off in UK house-building. Five of the top 20 house-builders saw pre-tax profits fall this year, and by significant margins.

The biggest fall in profits was at Keepmoat, which reported an otherwise satisfactory set of results with increased sales and turnover up more than 31% to £556m. Pre-tax profits however nose-dived from £25.4m to £13.5m in the year to 31st March 2018 – a fall of nearly 47%. The cause was a number of “significant trading issues” on a number of sites in the West Midlands which cost the business £13.2m.

Keepmoat has since closed its West Midlands office. During the year it also completed the sale of its regeneration division to ENGIE for £313m.

Retirement homes specialist McCarthy & Stone also saw profits slump, a consequence of a rising cost-base and its almost unique exposure to the vagaries of the second-hand property market. Pre-tax profits fell by 37% from £92m to £58m, the company blaming “continuing economic uncertainty and a slower secondary market”.

Crest Nicholson’s figures are for the year to 31st October 2017 and show pre-tax profits down 29% to £118.7m (2016: £167.2m). The company is not due to file its 2018 results until April, but last month it issued a profit warning, saying that pre-tax profits for the year were unlikely to hit the £205m it forecast in its half-year results released in June.

Again, rising costs and a weakening market are to blame. Galliard Homes, meanwhile, recorded a drop on both turnover and pre-tax profit, which it says looks worse than it actually is due to changes in accounting practices and the way joint venture partners’ share of profits are accounted for.

Bovis Homes reported both turnover and pre-tax profits down in the year to 31st December 2017, the most recent figures filed with Companies House. But interim results published in September hint at better things this year. Pre-tax profits for the first half of 2018 are £60.2m, up 41% compared with the same period last year, when millions were spent sorting out customer care problems caused by botched building work and employing lawyers and bankers to fend off takeover bids.

The turnaround is largely thanks to operational changes introduced by new CEO Greg Fitzgerald, previously of Galliford Try, who joined the firm in April 2017.

None of the top 20 house-builders can be said to be facing real difficulties, but they are all facing the prospect of leaner times ahead. Several make pointed references to the ‘cyclical nature’ of the sector in their annual reports.

Externally, there are other signs of change in the offing. The Halifax has recently observed that the rate of house-price inflation is at its lowest for five years while the Nationwide Building Society’s property index showed property values fell by 0.5%, month-on-month in August, the biggest decline since July 2012.

Brexit is also having a noticeable impact on the share value of UK-focused firms, house-builders especially. Following this month’s cabinet resignations over prime minister Theresa May’s proposed Brexit deal, shares in Persimmon, Taylor Wimpey, Barratt and Berkeley all closed down between 6.2% and 7.5%.

This article was first published in the December/January 2019 issue of The Construction Index magazine

UK readers can have their own copy of the magazine, in real paper, posted through their letterbox each month by taking out an annual subscription for just £50 a year. Click for details.

Got a story? Email news@theconstructionindex.co.uk