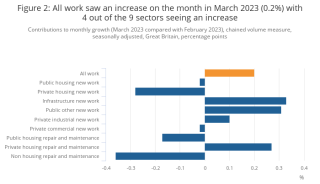

Monthly construction output is estimated to have increased by 0.2% in volume terms in March 2023, thanks to a 0.7% increase in new work, partially offset by a 0.6% decrease in repair & maintenance compared to February.

The rise in March represents a slowing of growth, given that growth in February was 2.6%, according to official statistics. February’s estimate has been upgraded in the past month – it was previously put at 2.4%.

While March’s rise might have been smaller than February, it still took construction output to its highest level (£15,616m) since the current form of records began in January 2010.

Infrastructure new work and public other new work were the largest contributors to March’s increase, up 2.2% (£51m) and 6.5% (£48m), respectively.

The largest negative impactors were non-housing repair & maintenance, which decreased 1.8% (£56m) – and was the main contributor to the fall in overall repair & maintenance – and private new housing, which decreased 1.4% (£45m). The private housing sector has had five monthly falls out of the last seven.

The March 2023 bulletin from the Office for National Statistics (ONS) shows four out of the nine sectors of the construction industry rising. The main contributors to the monthly increase were infrastructure new work and public other new work, which increased 2.2% (£51m) and 6.5% (£48m), respectively.

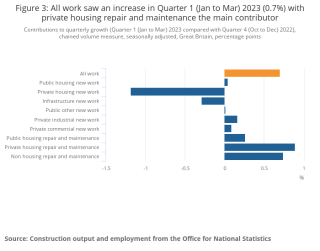

Across the first three months of 2023, quarterly construction output increased 0.7% (£330m) compared with Quarter 4 of 2022. That increase came solely from a rise in repair & maintenance (4.9%), as new work saw a decrease of 1.9%.

This is the sixth quarter of consecutive growth in the quarterly series since Q3 2021 (1.6% fall). However, the quarterly growth has slowed in comparison with the first half of 2022. It was quite a turbulent three months for GB construction output, down 1.6% in January up 2.6% in February and then up just 0.2% in March.

However, total construction new orders decreased 12.4% (£1,571m) in Q1 2023 compared with Q4 2022. This quarterly fall came mainly from private commercial and private housing new orders, which fell 22.3% (£773m) and 18.4% (£607m), respectively.

The annual rate of construction output price growth was 8.5% in the 12 months to March 2023; this has slowed slightly from the record annual price growth found in May and June 2022 (10.4%).

.png)

Fraser Johns, finance director at Beard Construction, said: “The story of Q1 as a whole was one of volatility as a lack of confidence carried over from last year, resulted in a difficult January and repair and maintenance making up for new work. However, March’s data shows the tide beginning to turn with an increase in new work offsetting a fall in repair and maintenance, and another increase in monthly construction output – the highest level since January 2010.

“As we’ve headed further into the year, there’s no question the outlook has improved, helping to alleviate some of the bottlenecks and cost pressures found on site and encourage greater confidence among clients and firms. It’s positive to see more clients committing to new projects once again and the likes of infrastructure new work and public other new work continuing to be key drivers. This certainly reflects what we’re seeing on the ground at Beard.

“Rather than ‘all systems go’, today’s news should be seen as positive progress. After all, there are still struggles across a number of key sectors such as housebuilding, and the stubborn nature of inflation is definitely creating pockets of uncertainty. In all cases, staying close to clients and stakeholders is essential, as well as adapting to opportunities in sectors that offer the greatest potential.”

David Savage, partner in the construction team at law firm Charles Russell Speechlys, said: “February saw the construction sector get a significant boost and the March figures released today maintained those good signs of continued growth, recording the highest ever level of construction output since records began.

“As we emerge from a challenging winter period, the ONS figures are generally painting a brighter picture for the sector, and indeed the wider economy. The March figure benefited from a 0.7% increase in new work, albeit also seeing a decrease in repair and maintenance work – a fall of 0.6% - and the category of activity which had contributed so positively to the February figures.

“Thanks to fading recession fears and an improving global economic outlook, the sector can look forward with renewed confidence as the productive summer months approach.”

Clive Docwra, managing director of property and construction consultant McBains, said: “The modest increase in output will provide a measure of good news for the construction industry, especially given a large proportion of work during the month would have been impacted by it being the wettest March for more than 40 years.

“But the private housing and commercial sectors are still weak, with the 0.2% increase in output being largely down to other work sectors. The picture in the housebuilding market in particular is still mixed, which is not surprising, because although reports elsewhere show house prices are rising which would normally trigger an increase in construction activity, most developers are still planning to reduce by about a quarter the number of homes they planned, and further land purchase is also on hold until the economic forecast becomes clearer.

“More generally, cost pressures and materials shortages seem to be stabilising, but it’s too early to say whether this represents a longer-term recovery, especially given the ups and downs of the last three years. This is reflected by the first quarter figures of 2023 showing total orders decreased by more than 12 per cent compared with the final quarter of 2022.”

Got a story? Email news@theconstructionindex.co.uk

.png)

![Construction output in Great Britain [Office for National Statistics]](/img-cache/a12f885e908de57fd536389593f5354c/750x500_top_1683876887_figure-1-monthly-all-work-construction-output-index-in-march-2023-increased-on-the-month--with-an-increase-in-new-work--0.7----offset-by-a-decrease-in-repair-and-maintenance--0.6--fall-.png)