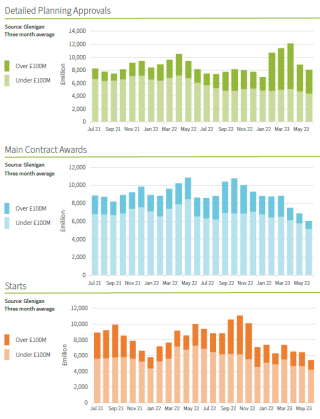

Detailed planning approvals declined by 29% in the second quarter of 2023, compared to the first quarter, and by 1% on 2022 levels.

Data gathered by Glenigan indicates that construction project starts were down 26% in the second quarter of the year, compared to the first three months, and down 42% compared to Q2 2022.

Main contract awards also fell 32% during the three months to June, and down by 30% against the same time a year ago, Glenigan reckons.

Economic director Allan Wilen said: “The construction industry continues to be buffeted by strong headwinds with little sign these are going to calm down in the near future. As our latest forecast shows, the next six months will likely be turbulent ones. Upcoming interest rate hikes will further hinder projects moving to site, and we’re already seeing work falling back in the civil engineering sector with marked declines in both infrastructure and utilities. Whilst there are small signs of recovery in the long term, with positive private housing starts an example of stabilising conditions in some verticals, consumer and investor confidence still remains low, generally stifling activity in the here and now.”

Overall, Gleingan’s July Review paints a picture of general decline, with almost all sector verticals dropping against Q1.

Residential construction experienced a slight upturn in Q2 as starts increased 10% on Q1 (seasonally adjusted) but were down 40% on 2022.

The hotel & leisure sector was the only one to grow in Q2. Project-starts increased a modest 2% on Q1 and 1% up on the previous year.

The value of industrial project starts in Q2 was up by 1% compared to Q1, but down 33% on the year.

In health performance, the value of sub-£100m project-starts rose 51% in Q2 compared to Q1, but was 22% down on Q2 2022.

Office starts were disappointing, with the value weakening against both Q1 and the previous year, declining 38% and 57%, respectively.

Retail project-starts also slipped back abruptly, declining 14% against the preceding three months to stand 44% down on the year before.

Civil engineering work starting on site was 40% in Q2 than Q1 and 54% down on a year ago. Utilities starts also declined by 44% against the three months to the end of June, finishing 45% down on a year ago.

Got a story? Email news@theconstructionindex.co.uk