Earthmoving contractors are usually quick to notice a change in the construction industry climate, being among the first specialists to start on site after a project gets the go-ahead.

On that basis, with major projects such as Hinkley Point C and HS2 getting under-way, you’d probably expect the earthmoving sector to display signs of vigorous growth. Instead, the reverse is true for many in our sample of the 20 leading earthmoving specialists.

Although overall statistics remain positive, individual company figures paint a mixed picture, with a few of the top 20 doing very well and the rest posting poor or indifferent results.

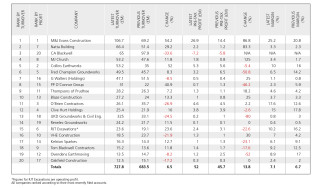

Overall turnover for our sample has grown by 6.6% to £728.3m, from £683.5m this time last year. Overall pre-tax profit has also risen, from £45.7m to £52m, an increase of almost 14%, and average margin has crept up from 6.7% to 7.1%.

But illustrating how patchy the picture is, seven of the top 20 registered a decline in turnover in the past year and nine (nearly half the sample) saw pre-tax profits fall.

In previous years CA Blackwell has always topped our table as the biggest UK earthmoving contractor by turnover. This year, however, it has toppled from its perch and now comes in at number three.

In the year to June 2017, CA Blackwell’s turnover slipped by a huge 33.6%, from £97.9m to £65m. The business hasn’t recorded a profit before tax since The Construction Index began tracking its performance three years ago. In 2016-17, its losses increased by £1.4m, putting the business £7.2m in the red.

CA Blackwell’s losses are largely attributable to three ‘legacy’ contracts which were inherited by its current owner, transport and logistics group Hargreaves, when it acquired the business in 2015. In its annual report, Hargreaves states that these three contracts reported £5.5m (2017:£15.1m) of “revenue and incurred operating losses of £3.4m in the year (2017:£3.4m), which are recorded as exceptional”.

These contracts are now all completed and “full provision has been made for all expected losses,” says Hargreaves, which adds that it is now pursuing a claim against CA Blackwell’s previous owners for breach of warranty.

Though its performance lacks sparkle now, CA Blackwell predicts better things to come. The company reports that it has been selected “as a strategic partner to one of the major contractor consortia for two sections of earthworks on the HS2 rail project”.

It currently has two major contracts underway: a share of the bulk earthworks on the A14 improvement project; and contract mining activity at the Hemerden tungsten mine in Devon.

CA Blackwell’s position at the top of the table is now occupied by M&J Evans, the Walsall-based earthmoving and civils contractor founded in 2004 by managing director John Evans.

The year to 30th November 2017 marked a milestone for the company and saw its turnover break through the £100m barrier for the first time, reaching £106.7m. This represents a 54.2% increase on the previous year’s turnover (£69.2m) and it yielded a pre-tax profit of £26.9m (2016: £14.4m) – a huge 87% increase.

Evans’ earthmoving business is heavily dependent upon the house-building industry – its client list includes most of the big names: Barratt, Taylor Wimpey, Redrow, Persimmon and Bellway to name a few. At the end of 2018, M&J Evans secured “significant” funding from private equity firm Bregal Freshstream and announced plans to boost growth.

Founder and managing director John Evans confirmed that “Bregal Freshstream’s support and advice will enable us to accelerate our ambitious growth strategy both in the Midlands and beyond.”

.png)

With a pre-tax profit of almost £27m (and a margin of over 25%), M&J Evans is by far the most profitable of our top 20 earthmovers. Coming a distant second is Collins Earthworks, ranked number five by turnover with revenues in the year to December 2017 of £53.2m and pre-tax profits of £5.3m. Collins’ pre-tax profit figure is actually slightly lower than the previous year’s (2016: £5.6m) but its turnover has leapt more than 50% from £35m.

The company now has plans to streamline the business. At the end of 2017, when its latest figures were filed, Collins announced that it had bought a new piece of land and had plans to relocate the business to this one site within three years. “This will enable the company to work from one business site and result in a reduction in the overheads of the company in relation to premises costs,” it said.

Collins also plans to spin-off the increasingly busy transport side of the business into a separate company. “This will reduce sales for Collins Earthworks Limited, however it will also result in a reduction in staffing levels and costs,” it says.

Similar action has been taken by Hampshire-based Blaze Construction, ranked at number 10 by turnover on our table.

Blaze made steady progress in the 12 months to November 2017, with turnover increasing 13.3% to £27.3m (2016: £24m). It also increased its pre-tax profits from £0.8m to £1m over that period. “Careful management of contracts and cost efficiencies on site” have paid off, and all extra work the company has taken on has been undertaken by subcontractors, which has avoided the cost of recruiting extra staff.

Like Collins, Blaze is “looking to move to one new location which will have the capacity to house both office and plant. This will in the long term reduce establishment costs and improve efficiency within the business,” said the company.

Several contractors have suffered a fall in revenues, and for a variety of reasons. Strangely, though, the never-ending Brexit uncertainty does not appear to be one of them. UKD Groundworks saw turnover fall almost 25% from £33.1m to £25m in the year ending 30th April 2017. It blames “the actions of the Company’s principal client, Barratts” and vows to increase its client base, rather than put all its eggs in one basket.

UKD is also bracing itself for unforeseen tax and national insurance liabilities in the wake of last year’s Supreme Court ruling in favour of HMRC against Glasgow Rangers and its use of Employee Benefit Trusts (EBTs). UKD has its own EBT.

VHE also saw turnover slump, by 22%, from £23.7m to £18.5m in the year ending 30th September 2018. The main reason, it said, was “deferred project starts on both frameworks and tendered works for new clients.” Pre-tax profits, however, grew by 30% to £1.3m.

Welsh contractor Walters, which saw 2017’s turnover fall 8.5% to £47.1m from £51.5m the previous year, is continuing to pursue “early contractor involvement” projects on the national road network (it is the main earthworks contractor on the A14 upgrade in eastern England, which is now drawing to a close).

But despite a slight hiatus in the workload, Walters hints at more goodies in the pipeline: “Nationally, the company is awaiting on several strategically important high-profile projects across the UK that it has targeted to be awarded. Couple [sic] to these awards the company is awaiting various announcements on procurement routes for numerous major infrastructure schemes and frameworks.”

This article was first published in the February 2019 issue of The Construction Index magazine

UK readers can have their own copy of the magazine, in real paper, posted through their letterbox each month by taking out an annual subscription for just £50 a year. Click for details.

Got a story? Email news@theconstructionindex.co.uk